January was a unique and interesting month for my portfolio. Two big things happened: 1.) two of my holdings were exchanged for their Class B siblings, which I’ll explain in more detail below and 2.) I had my largest Dividend/Coupon payments ever. In this post, I’ll share more detail into my specific holdings.

First lets cover the not so fun stuff, expenses. I owed $5 for the ability to use Robinhood Gold and owed $116 in interest to Robinhood for using leverage through the billing period. At this point, my core holdings are not using this leverage. I am using Robinhood’s leverage to swing trade and to pull funds out to pay the monthly borrowing payments. I owed $394 this month to my credit cards and another $2,431 on my personal loan. In total my portfolio cost me $2,946 in January.

Now for the upside, my swing trading netted me $1,832 this month. I buy and sell ETN’s as well as some other dividend paying stocks. I never sell at a loss, never. If I get caught in a down swing in price, I simply hold and collect the dividends until the price comes back up. This has happened a few times over the last year. The hardest part about swing trading is remaining emotionless. I try to get in and get out in the same day, known as day trading. I don’t try to hit home runs where the prices goes up significantly and that’s when I cash out, but I usually set a target to make between $50-$150 per trade.

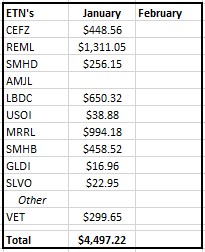

As mentioned in my second point above, I made the most I’ve ever made in a month in coupons/dividends. In January I was paid $4,497! This came from 9 ETN’s and one common stock, VET. This was one of those trades I was holding until it came back up in price so I didn’t take a loss. I was paid $300 just for holding this stock through the ex-dividend date which was the end of December. I later sold in January for a profit as well!! Of the ETN’s one of them only pays each quarter, LBDC. so every 3 months my payouts overall are bigger. Here’s a table of the income in January:

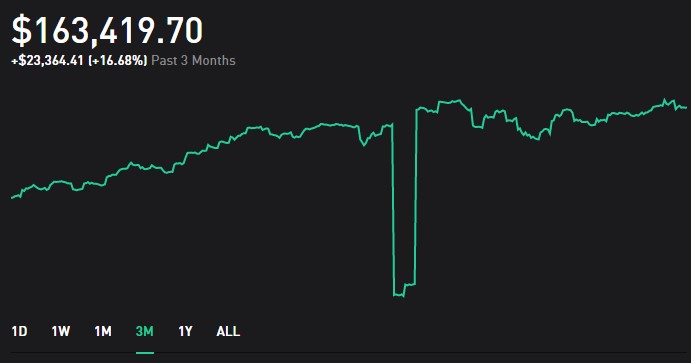

Another unique action that took place in January was an exchange of ETN’s. I had two Series A ETN’s in which UBS currently has a voluntary exchange happening. We have the option to trade our Series A ETN’s for Series B which are essentially the same notes. I was invested in CEFL & BDCL which are part of the exchange. There was a 2 day period in which my current holding were frozen while the exchange of notes was taking place. My portfolio showed a temporary $44k decline. See picture below for what my portfolio did during that exchange period.

As noted in my previous post, https://kittleinvestments.com/what-are-etns/ ETN’s are a unique asset class that needs to be watched closely. Another ETN, SMHD will be redeemed later this year. I will need to make a decision on what to do with this note in the next few months. If redeemed at the current price, I will receive $2.56 per share less than what I paid representing a $2,600 loss. I problem I now get to solve.

Stay tuned for my February ETN high leveraged portfolio update. I’ll also start posting about my peer to peer lending investments soon.

Be Awesome!

Cut costs with our cheap creating support | Get big superior quality papers of any trouble amount but to get a truthful worth!